If you need some quick cash, one option that you might have heard of is a pawn shop loan. But is this a good way to get the money you need? In this blog post, we’ll explore what a pawn shop loan is, how it works, and the pros and cons of going this route.

Is a Pawn Shop Loan a Good Idea?

First, let’s explain what a pawn shop loan is. Essentially, it’s a type of secured loan where you offer an item of value (like jewelry, electronics, or musical instruments) as collateral.

The pawn shop appraises the item and offers you a loan based on its estimated worth. You can then take the loan and leave your item with the pawn shop, which will hold onto it until you repay the loan with interest. If you can’t repay the loan, the pawn shop keeps the item, sells it, and recoups their money.

What You Need To Keep in Mind

One of the advantages of a pawn shop loan is that it’s relatively easy to obtain. You don’t need to have good credit, and you don’t need to fill out a ton of paperwork. As long as you have an item of value, you can get a loan.

Plus, pawn shops are often open seven days a week, so you can get cash when you need it!

One of the most important things to consider is that if you can’t repay your pawn shop loan, you’ll lose your item of value. This can be a downside if the item has sentimental value, like a family heirloom.

However, if you are not particularly attached to the item, you can consider selling it to a pawn shop instead of pawning it. This way, you part ways with your item definitely but usually get more cash compared to pawning.

What Items Can I Pawn?

A variety of items can be pawned at a pawn shop, but what is accepted may vary depending on the specific shop. Here are some common categories of items that are often accepted:

- Jewelry

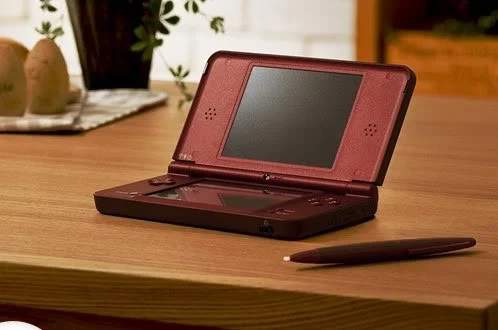

- Electronics

- Musical Instruments

- Power Tools

- Antiques and Collectibles

- Smartphones

- Luxury fashion items

Remember, the value of the item you’re pawning will determine the amount of money you can borrow. The condition, age, and demand for the item will also impact its value. Always ensure to check with your local pawn shop to see what items they accept before bringing in your items.

Here’s a selection of previous blogs answering some common questions about the items you can (and cannot) pawn or sell at a pawn shop:

- Can You Pawn Engraved Jewelry?

- Can I Sell My Cell Phone To a Pawn Shop?

- Can You Pawn Shoes?

- Can You Pawn an Apple Watch?

- Will a Pawn Shop Buy a PS5?

- Do Pawn Shops Buy Drones?

- Do Pawn Shops Take AirPods?

- Pawning Your Louis Vuitton Handbag: What You Need To Know

Wrapping It Up

So, is a pawn shop loan a good idea? If you need cash quickly without the hassle of lots of paperwork, then the answer is yes.

Just make sure you understand the terms of the loan, including when you need to repay it an the appraisal process. Also, always have a plan to repay the loan on time to avoid losing your item of value!

Ultimately, the decision is yours, but hopefully, this post has given you a better understanding of what to expect from a pawn shop loan.

AJ’s Super Pawn: Pawn Shops in Pomona and Chino, California

If what you need is a dependable, trustworthy pawn shop in Southern California, look no further than AJ’s Super Pawn.

We have locations in Pomona and Chino California. Give us a call today (Pomona: 909-622-0334 , Chino: 909-465-5456) or fill out the contact form to get in touch with our team!